New Zealand’s search for oil

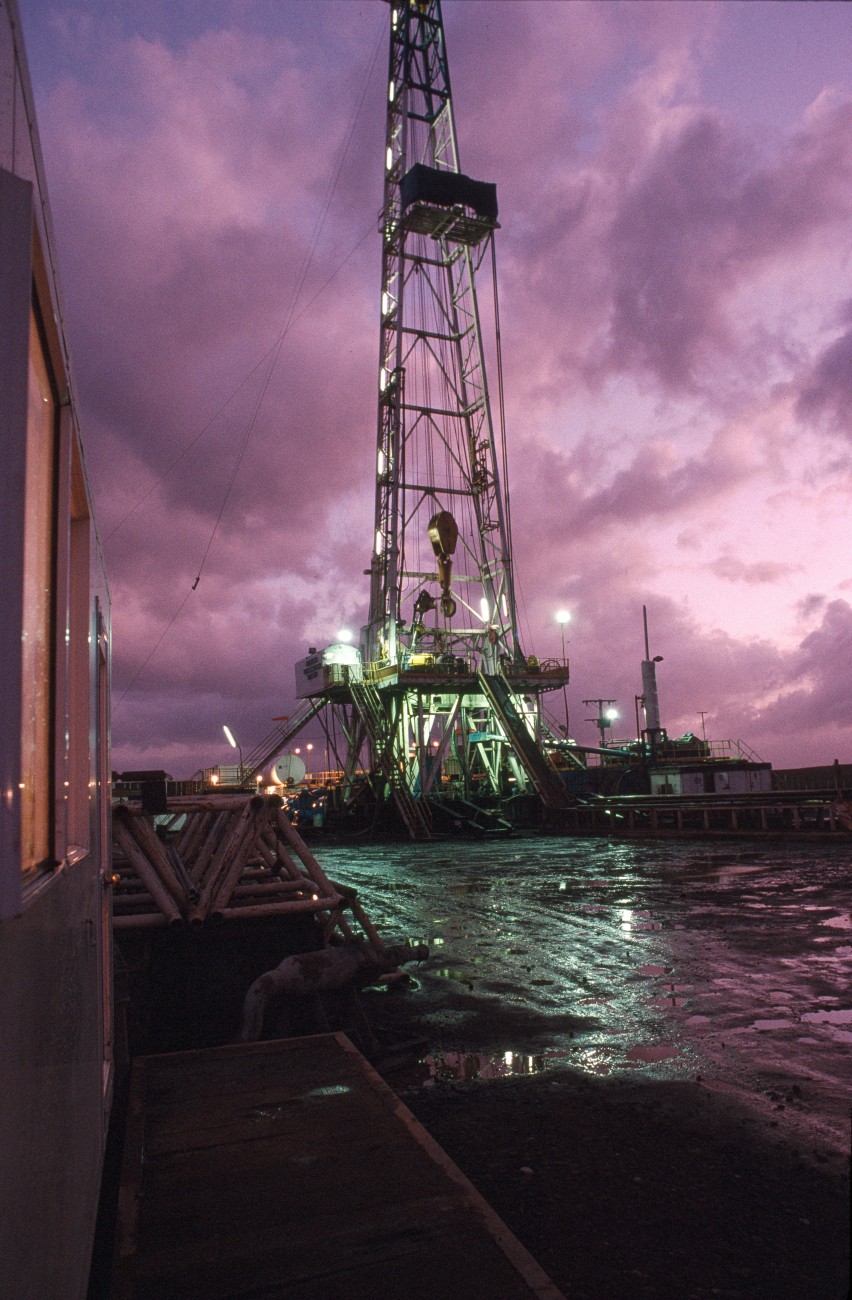

Freshly hauled from the borehole, the drill string dribbles mud as roughneck Ross Hopkins struggles with a tight connection. Wresting oil from the rocks is not getting any easier, but our need for new discoveries is becoming pressing.

“May donkey urine be your drink, naptu [oil] your ointment” was a term of abuse in Babylon 4000 ears ago, and it captures the essence of what the ancients thought of crude oil: at best a curiosity for visitors, but for the most part an unwanted effluent. Atop the world’s largest oil accumulations, they couldn’t help but notice the sticky, stinky, inflammable stuff oozing out of the earth’s pores like so much black sweat. Later they used tar as mortar and in warfare. What better substance to fuel a burning arrow than crude oil?

We moderns have come up with a raft of new uses for oil, and the problem now is getting enough of it. For the most part. it stays concealed under the ground, and finding it is a challenge which exercises some of the world’s best geological minds.

The place to start looking for oil is in sedimentary basins. These tend to form where one of the earth’s tectonic plates slides under another. Erosion from nearby land carries mud, sand and gravel into these depressions, along with organic material—mainly plant matter and plankton—which is the precursor of hydrocarbons.

As gardeners will appreciate, decaying plants tend to form compost rather than coal and oil. Hydrocarbons can only form where plant matter is quickly buried before decaying, usually in an aquatic setting where there is little oxygen. A sedimentary basin which is being steadily filled with fine mud or clay particles (which effectively seal out air) is ideal. Such an environment could be a shallow lagoon, swamp, river delta, estuary or harbor, but whatever it is, the sedimentation process needs to operate for thousands if not millions of years to provide a worthwhile buildup of organic matter in the consolidating rock for hydrocarbon formation later. Rates of sediment build-up vary, but a value of 10-50 meters per million years is typical. In some basins sediments reach a thickness of 8 or 9 km.

As they become more and more deeply buried, the organic-bearing clayey rock strata (called source rocks) are compressed and heated. Water and soluble organic compounds are forced out of the rock as it is squeezed, leaving behind an in soluble, greasy organic sludge termed kerogen.

Geologists refer to the combinations of temperature and pressure responsible for this and other chemical transformations as a “kitchen.” Kerogen formation takes place at depths no greater than 1000 m and at temperatures up to about 50°C—a “mild” kitchen. To convert kerogen into hydrocarbons requires more severe kitchen conditions—typically 65° to 150°C, and burial a few kilometers below the surface.

Temperature is probably the vital parameter; in a “cold” basin, where rock temperatures increase by only 1 or 2°C per 100 m depth, the kitchen will be deeper than in a “hot” basin where the thermal gradient may run as high as 8°C per 100 m. Where source rocks have not been buried deeply enough for long enough to reach kitchen conditions, a basin is referred to as “immature”—try again in another ten million years.

The kerogen starting mixture contains hydrogen, oxygen, carbon, nitrogen and sulphur, but in hydrocarbon formation (as the name suggests) only hydrogen and carbon are important. When the cooking starts, the first products are mainly water and carbon dioxide. As temperatures increase, the organic constituents of the sediment are progressively transformed into two fractions, one a fluid rich in hydrogen that will become oil and gas, and the other a residue high in carbon, similar to anthracite coal.

It is worth noting that the hydrocarbon fluid fraction (crude oil) contains a very complex series of compounds. The simplest useful component is methane, termed natural gas and also generated in swamps, rubbish dumps, and digestive systems. Propane and butane are slightly larger molecules, and therefore a little less volatile. They can be condensed as liquids at temperatures not much below 0°C and are sold as LPG (liquefied petroleum gas). Beyond these are a vast array of components of increasing complexity and decreasing volatility. Petrol consists of a cut with boiling points between 25 and 150°C, kerosene 150-230°C, and diesel 230-340°C.

The conversion of kerogen to hydrocarbons is an exceedingly slow process—a rate of five per cent in a million years is considered speedy. Time in geology is as incomprehensible to us as light years are in astronomy. If a kitchen produces one liter of hydrocarbon per day, after ten million years there will be 22 million barrels. (We, of course, consume nature’s cooking in just a few unappreciative gulps!)

[Chapter-Break]

While Source rocks generate hydrocarbons, they seem generally not to retain them. This is because increasing pressure on the clayey source rocks by sediment bearing down from above starts choking out pore spaces able to hold fluid. Volatile gases derived from the kerogen also increase pressure within the source rock, giving impetus for hydrocarbon expulsion. Pressure, lack of pore spaces and the fact that hydrocarbons are lighter than water (which is always present in these rocks), result in the hydrocarbons being pushed towards the surface.

It would do the hydrocarbons no good to remain in the source rocks anyhow. If they were to stay in the kitchen too long or get too deeply buried and overheated, they would, like any baking, start to spoil. Processes that broke the large kerogen molecules down into smaller hydrocarbons would continue, and eventually all the hydrocarbons would become simple gases.

Geologists speak of petroleum “windows.” meaning that in a column of source rocks the higher strata will be immature, the very deeply buried rocks will be overcooked or over-mature, but somewhere in between will be optimal for the production of oil and gas—the petroleum formation window.

So, typically, the source rock is left barren while the oil and gas move on. Travelling through permeable rock types or along fracture lines, hydrocarbons may move just a few thousand meters or hundreds of kilometers. Sometimes they will make it to the surface and be dissipated as an oozing oil seep.

On fortuitous occasions the flight of the hydrocarbons will be halted by another type of rock indispensable to petroleum accumulation: the impermeable cap or seal rock, usually a very fine-grained sedimentary rock such as clay stone or limestone. For oil and gas to accumulate, however, there must be porous and permeable reservoir rocks beneath the seal. Typically these are coarse-grained sedimentary rocks like sandstone, and they are the target rocks drillers aim for. Not only must cap and reservoir rocks be present together, but they need to form a structure that the oil can run into and not escape—a “trap.”

The simplest arrangement of cap and reservoir rocks which will snare oil and gas is an inverted basin-like bulge or anticline. Tapping large structures of this type worldwide has provided us with much fuel in the past, but these structures have mostly been found and probed, so geologists are now testing a variety of more subtle structural and strati graphic traps, especially those associated with faults.

A final requirement for the creation of an oil deposit is more ephemeral—what geologists call timing. The necessary geological structures outlined above must not simply be in place now. They had to come together perhaps 10 or 50 million years ago, when a given batch of source rocks started to expel hydrocarbons. For instance, if the cap rock wasn’t em placed for another 20 million years, any hydrocarbons generated would have been lost. This is thought to have been the case with the submarine volcano Kora west of Awakino. Exploratory wells sunk in the late 1980 s found that oil had been there but had mostly departed. Probably it flowed up through the permeable rocks of the volcano and escaped out the top, since cap rocks had not then sealed the structure. Now, too late, the volcano is buried under 1.5 km of sedimentary rock.

The probability that some long-extinct organism’s remains will contribute to the petrol in your car (or anybody else’s) is actually exquisitely small. An eminent American scientist, Philip Abelson, has estimated that, over the time that Earth has existed, organic matter equal to the weight of the Earth has been synthesized into hydrocarbons. Yet of this, only one part in 10′” has been preserved, and little of this is petroleum. A realistic estimate is that only one part in a thousand of organic carbon preserved in sedimentary rocks exists as oil or gas in known reservoirs.

The task of the hapless petroleum geologist is to attempt to sleuth out these sparse relics of ancient life, in those uncommon lairs where they have holed up and formed commercially worthwhile hydrocarbon deposits, deep within the earth.

It seems impossible. How do they do it?Feigned Bock, a geologist originally from the Netherlands but now with Petrocorp Exploration in New Plymouth, explained the craft to me.

“In the early days, oil exploration was done by field geologists, mostly on foot, ranging anywhere in the world. They’d collect rock samples and map outcrops to discover possible sedimentary basins. Nowadays, it is much easier to find these basins from aerial photographs, supplemented with a lot less fieldwork. Magnetic and gravity anomaly surveys—also possible from the air—can’t detect hydrocarbon deposits directly, but may reveal the extent of a feature of interest. From this information a geologist can make reasonable guesses about what’s happening underground. To get more precise you usually have to ‘shoot some seismic’.”

In the same way that an obstetrician checks an invisible infant in the womb with ultrasound, geophysicists can figure out how the rocks are layered for kilometers below their feet using seismic techniques. Explosives, heavy weights, or, at sea, air guns are used to generate low-frequency shock waves that travel rapidly through the ground. Discontinuities in the rock—such as may be caused by different rock types—reflect back a small amount of the waves’ energy to the surface, where sensitive vibration detectors (called geophones on land) pick up the very weak signals. The deeper the reflecting rock, the longer the signal takes to get back. Data appears as a series of black blips on a printout over about a five-second time span. Shock waves in rock travel at about 3000 m per second, but there is significant variation between rock types. In marine seismic work, hydrophones (similar to those used by wartime submarines to detect the motors of enemy ships) monitor the vibrations.

I watched a seismic team in action the hill y country of east Taranaki,beyond Midhirst. What started as a short, easily drawn line on a map back at Petrocorp headquarters translated into twelve-and-a-half kilometers of hard work in the field.

Surveyors begin the process by accurately determining elevations all along the line, and placing numbered white pegs at precise 12.5 m horizontal distances. Every fourth peg is red, and at these positions a 10 cm-wide hole, 19.5 m deep is drilled by a separate gang using a tractor-mounted rig, or one transported by helicopter to the many steep locations.”Shooting”-detonating a couple of kilograms of dynamite down each hole-starts at one end of the line and works along at a speed of one blast every four or five minutes. Before the fireworks can start, however, the geophones have to be positioned and connected to the nerve center, a truck fitted out with computerized recording gear.

Readings are made from six kilometers of line at a time-6000 geophones, since twelve are laid out in a precise array at each white marker. Vividly colored cables like heavy duty extension leads connect with a solid metal junction box at each of the markers and snake back to the truck. One team extends the cable and places geophones at the head of the line, while another dis‑ assembles at the rear. Cables, boxes and geophones are ferried by helicopter from the back of the line to the head.

In the middle of the line the “shooter” lets the technician a few kilometers away in the truck know when everything is ready, because the blast is triggered from the truck. Antoine, the technician—very young-looking, unshaven, cigarette in long-nailed fingers—isn’t happy. He’s having language troubles. New Zealand doesn’t generate enough seismic work to keep a local company busy, so our jobs tend to be aggregated and then put out to over seas tender. CGG, a French company, is doing the work, and Antoine is having a lot of trouble understanding our local accent, especially when distorted by a radio telephone and smothered by the helicopter’s throb. Peter McPherson—a Melbourne-based Scottish geophysicist whose immaculately modulated English more than compensates for the Frenchman’s deficiencies—keeps an eye on the work on behalf of Petrocorp, although he too is under contract. In the company of Dutchman Feike de Bock, I can’t help reflecting that, where oil is involved, not even the heartland of Taranaki is a Kiwi preserve.

Apart from language, cows present the seismologists with more problems than the terrain. “They chew the cables,” grimaces the despairing Antoine earlier in their stay the party acquired seismic data in the suburbs of New Plymouth using fibrosis trucks. Where dynamite cannot be used, a convoy of these specially designed trucks generates vibrations through a large plate pressed against the ground. Geo phone arrays detect reflected waves as in the dynamite technique.At $20,000 per kilometer, seismic surveys are not cheap, yet some 150,000 kilometers have been shot around Taranaki and elsewhere in New Zealand.

In recent times three-dimensional seismic has been introduced. A closely-spaced parallel series of regular seismic lines are shot, and the results integrated to give a three-dimensional reconstruction of underlying rock formations.

The largest, most successful and most expensive ($30 million) 3-D survey carried out here so far was in the first half of 1991, and covered 1000 km2 of the Maui field. It involved bringing two specially equipped 60 m ships from the North Sea. To make the survey the vessels had to sail in parallel no more than 200 m apart over the whole area. Each ship towed two arrays of powerful airguns and two seismic cables 3.5 km long, each containing 5760 hydrophones. Data collection points were spaced 25 m apart in a square array across the entire area, and each data point was sampled 20 times Had the data been closely typed it would have formed a pile of A4 pages 20 kilometers high! For the data to mean anything, the exact position of every airguns and hydrophone had to be known. Those 3.5 km lines of hydrophones could drift a long way in the rough seas off Taranaki, so five separate positioning systems were used to ensure pinpoint accuracy. Apart from rough weather, the only major problem was damage to the seismic lines from shark attack. (Cows and sharks have not been widely regarded as equivalent nuisances before.)

All the raw data was collated and processed on supercomputers in Europe, and the refined results then installed on Shell Todd Oil Services (STOS) computers in New Plymouth. The very close spacing of all the data points means that a much clearer picture than ever before has been gained of the important Maui field. Despite their remoteness and the fact that they are submerged under 100 m of sea, these rocks are possibly the best known under ground structures in the country. An immediate pay-off from the survey was the discovery of oil in rocks immediately below the gas-bearing formations under Maui B. The estimated 20 to 50 million barrels could be worth up to a billion dollars.

[Chapter-Break]

If seismic surveys are like ultra sound, drilling is the biopsy. Oil companies rank the hydrocarbon prospects as indicated by seismic work and drill exploratory or wildcat wells in the most promising. Rock fragments from down the well help firm up the seismic data, as does well analysis by logging instruments lowered down the borehole. A strike will usually be followed up by more exploratory wells to determine the extent of the find, and finally production wells will be sunk.

From up on a ridge that provides a vista from the North Taranaki bight to Egmont, drilling continues 24 hours a day, seven days a week. The large, transportable rig is only 50 meters from an existing well in the McKee field, yet using directional drilling techniques geologists hope to access a hitherto untapped pocket of the McKee formation.

The McKee field 15 km inland from Waitara has been in production for a decade, and the flow is starting to decline. Since much money has been invested in connecting scattered wells to the central production station (which is capable of handling double the field’s present 6600 barrels per day oil production), new wells are being sunk in an effort to expand the field’s output.

Dominating the site is the rig itself, a 55 m obelisk fingering the sky as it bites under the earth’s skin. Even more impressive than its height is the mass of steel supporting the drilling platform, the center of operations, some ten meters above ground level. Banks of huge motors, generators, and pumps cover hundreds of square meters around its base. None of it looks very mobile, yet I’m told the whole lot can be dismantled, moved and re-erected in just five days.

Much of the clutter is devoted to the handling of a substance that would seem to have no place in the glamour world of oil: mud. Not the miserable stuff that under girds the gumboot industry, but special drilling mud, the life blood of the operation. Thousands of liters of smooth grey mud creams its way through pumps, vats, shakers, centrifuges, stirrers, pipes and filters. Huge pumps force it down the hollow steel pipes (termed the drill string) that bear the drill bit, and perforations around the bit release it into the well and lubricate the bit as it cuts. Since the bit is wider than the drill string, the mud can travel back to the surface in the space between the drill string and the wall of the hole, carrying rock cuttings with it. On the surface the cuttings are separated from the mud, which is recycled.

Mud is also the first line of containment for preventing blowouts in wells. Underground gas and oil can be under enormous pressure. However, the not inconsiderable weight of a few thousand meters of mud bearing down on the gas is generally sufficient to at least slow its ascent up the well, if not prevent it entirely.

Drilling mud is a special concoction containing Benton (for its lubricant and sealing properties) and often the heavy mineral barite (also found in barium meals given to those undergoing digestive tract X‑rays). The driller constantly monitors pressure in the drilling system and the level of mud in his reservoirs. A rising mud level means that water, oil, or gas are displacing mud and coming up the well. The “mud doctor” can increase the density of mud by adding more barite. Beneath the elevated drilling platform are blowout prevention valves for sealing off the well if mud is unable to contain the pressure.

Two small sample bags are filled with cuttings from the mud every five metres the bit travels. One bag is held in the Ministry of Commerce’s library in Wellington while the other goes to the well owner, in this case, Petrocorp. Don McFarlan, the site geologist, regularly checks cuttings under a microscope. “They give us a good idea of the rock strata that the drill bit is passing through.”

Inside the site lab is monitoring equipment for detecting hydrocarbons in the mud and a hydrogen sulphide detector for sniffing out traces of this deadly gas. “If there is any sign, a siren goes off and the rig is cleared immediately. You only return once you have breathing apparatus on,” I’m told.

Wells are spudded in (oilspeak for “started off”) using a large diameter drill bit which is replaced with narrower bits as the hole deepens. To turn the bit, four 550-horsepower motors near the rig rotate a round plate in the platform floor, the rotary table. Through a square hole in the centre of the table passes a 12 m-long square section steel pipe named the kelly. At the top of the kelly is a swivel, so nothing higher up rotates.

A massive travelling block (weighing 11,000 kg) suspended from the top of the derrick by steel cables is hooked to the top of the kelly. The lower end of the kelly is threaded and attaches to a 9 m length of drill pipe, which attaches to another and another, right down to the drill bit. Above the bit are a series of thicker-walled pipes termed collars that put weight on the bit to give it bite. In this well there are 339 m of collars.

In normal drilling the rotary table turns the kelly, which rotates the entire drill string (possibly as long as 5000 m—hence the need for those enormous motors) including the bit. As the hole deepens, each extra length of pipe is added to the string just below the kelly.

When the drill bit wears out or breaks, the entire string must be withdrawn from the well. To speed the work, only every third joint is unscrewed, leaving the drill pipe in 27 m lengths which are stacked vertically on the rig by the derrick man. He perches on a precarious-looking platform 25 m above the drilling floor (the “monkey board”) lassoing and dragging the top end of the pipes into a rack. From below it looks pretty scary. One considers steel pipe not to be lacking in backbone, but these lengths towering above the platform arc and sag alarmingly.

“Spaghetti,” an assistant driller grunts. “Even the widest diameter drill pipe bends like that when it’s up there.” It is the need to handle these lengths that mandates the height of the rig. With several thousand meters of pipe to be hauled up and then reinserted, changing a bit can take eight hours of hard work.

This well is particularly challenging, according to Steve Laing, the directional driller. The target structure he is aiming for is a mere 10 m in diameter, and it is 2500 m down and perhaps a horizontal distance of 500 m away. Seismic surveying has pinpointed its location; now Steve has to hit it.

Directional drilling means making the drill bit head off in some desired direction apart from straight down. The directional driller is the specialist who overseas this wizardry. It is even possible to deviate a well so that it runs horizontally. An advantage of such deviated wells is that they can better tap oil-bearing rocks. If hydrocarbons are confined to a thin layer, a well running along the layer will extract more fluid than one crossing it at right angles.

Oil, not blood, flows in Steve’s veins. “My father worked for Shell, I was born in a Shell hospital in the West Indies, went to a company school and started working on drilling rigs when I was 15. By 19 I was a driller.” Drillers may in time become drilling supervisors (“tool pushers”), and directional drillers are more specialized again. Steve is only 35.

After an initial vertical descent, this well is to perform a gradual spiral to end up beneath a steep valley that it would be impossible to drill from.

For the lower, more demanding sections of this well, a screw-like turbine motor occupies the lower part of the bottom pipe to which the drill bit is attached. Mud forced through this motor under pressure turns the drill bit only, not the whole drill string.

Slower progress is the penalty incurred by this drilling technique. For Paul Jones, the driller, directional drilling means that 50 times a minute he has to lower the drill string a few millimeters to maintain the optimal weight on the bit.”Progress is about 6 m an hour this way, about half what we would be doing with the rotary table going,” he says. “It’s still not bad. In my father’s day it was rare to do more than two or three kellies a day (25 to 40 m) and each well took six months. You could never go down as deep as we are here, either.”

This well, at a little over 2000 m, is routine by today’s standards.Up on the drilling floor it is freezing cold. A southerly wind tears at the crudely rigged tarpaulin which affords the only weather protection. Snow is a distinct possibility tonight. The work is repetitive, continuous and not exactly riveting. Is it worth it?

Paul, who has been oil drilling nine years, thinks so. “Although I live here in New Plymouth, when work dries up locally, Parkers (the rig owners based in the US) move us overseas. I’ve just spent a year in Burma, which was pretty interesting. I work six weeks on, six off and get flown home for the six off. At $75,000 a year the pay’s not too bad either.”

[Chapter-Break]

Before you can do any drilling—or seismic—you need a petroleum exploration permit. The Energy and Resources Division of the Ministry of Commerce regularly advertises for bids for permits in areas where hydrocarbons are likely to exist. Applicants are required to submit a proposed work plan (e.g. kilometers of seismic, number of exploratory wells), and if there are several applicants, the permit will go to the one with the most vigorous programme. To minimise hyperbole in plans, awardees may be required to post a hefty bond which is forfeit for failure to perform. Permits are awarded for five years and may be extended or surrendered. If worthwhile discoveries are made, a mining permit valid for up to 40 years can be obtained.

While permits don’t at present cost money, government gets a percentage of production revenues. In practice, the Crown owns 11 per cent of each producing well and takes a 12.5 per cent royalty of all that is produced. Under a proposed new minerals regime, this will change to either 5 per cent of gross or 20 per cent of profits, whichever is greater in any year. After tax, the new rules will give government between 45 per cent and 60 per cent of profits, little changed from the old set-up.

Behind these changes is government’s desire to woo oil exploration dollars from overseas. The offshore Maui field, which currently produces the lion’s share of our gas and condensate (85 per cent), is expected to start declining within five years and to be exhausted by 2010. It can take a decade to develop a new offshore field, so we have to start searching now. The international competition for sparse prospecting funds has never been sharper, and if our government is perceived to be too greedy, there are plenty of holes to pour dollars into elsewhere.

By international standards, New Zealand—even Taranaki—is under-explored. Fewer than 250 exploration wells have been sunk in New Zealand, compared with 6000 in Australia and two million in the US. In the Gulf of Mexico alone, 30,000 wells have been drilled, all but 150 in the last 40 years.

Permit holders are not necessarily single companies. Frequently they are consortia—generally oil companies, but at times investors who are serious about gambling. Of course, if a company is convinced that it’s on to a winner, it won’t want partners. But generally prospects are not that firm, so partners are a way of hedging bets. A typical deal is the “2:1,” where the partner pays 50 per cent of the costs and will get 25 per cent of the profits. With two such partners, the oil company gets the well drilled for free, but still gets 50 per cent of the profits (less the government’s share).

Exploration permits typically cover a hundred to several thousand square kilometers, although all of the ocean to the west of the upper third of the North Island resides within a single 113,000 km’ block under licence to Conoco North land Ltd (basically a US company). Onshore mining permits are much smaller, just a few tens of square kilometers.

Brian Todd of Wellington was a particularly astute businessman who managed to secure petroleum prospecting licences over great tracts of country in the late 1940s before anyone else was interested. He was later forced to relinquish many of his licences, but cannily managed to retain those over areas that subsequently proved most productive, including both Kapuni and Maui. The international companies Shell and BP had to deal with him when they became interested in exploring within his licence areas, so Shell BP Todd was born. (BP decided to withdraw from local exploration in 1990, so the company is now just Shell Todd.)

Possessing a permit makes your activities legal as far as the government is concerned, but it doesn’t confer any rights of access to land. Federated Farmers and the Petroleum Exploration Association have recently combined to produce a land access code that lays out a framework for negotiating individual access contracts. Developments also have to comply with such legislation as the Resource Management Act and local body district schemes.

The first drilling ventures in Taranaki were shackled by few such constraints. Ron Lambert, director of the Taranaki Museum, has just completed a book on the search for Taranaki oil, and gave me a glimpse into those frontier days.First, though, he put me straight on a popular Taranaki myth: apparently, the 1865 well drilled at Moturoa on the New Plymouth foreshore was not the first in the Empire. Canadians had struck oil seven or eight years earlier.

It was local publican Josiah Flower Carter and a few of his friends who started the Taranaki oil story. They had come to New Plymouth on the strength of rumours of gold, but found themselves confined to the town by the land wars, so decided to seek oil in the safe port area where seeps were known. After some modest drilling and shoveling, they encountered gas at six metres. One of the workers was overcome and had to be hospitalized. At 20 m, oil seeped into the hole.

Ron leaned forward and scratched his chin. “Here we have to read between the lines a bit. They calculated the flow rate as being 230 litres per week, but probably on the basis of 5 litres for one hour, and I suspect that it ran out after an hour!”

Back then a good well produced only 12 barrels (1 barrel =159 litres) per day, mainly because of the recovery method. Oil was collected by bailing. A container with a valve in the bottom was lowered down the hole, the valve was opened, and when the container had filled it was hauled up by rod or wire.

Early in 1866, while Carter and his friends drilled on, two new local companies appeared: the People’s Petroleum Co and the well-heeled Taranaki Petroleum Co. The latter quickly took over the other two operations and drilled three more wells, one of which had a few shows and went down 200 m. Total commercial production from all the wells in these first few years amounted to just three barrels, two of which went to Australia to arouse investor interest.

In 1904 a group of Australians brought the first steel rig to New Zealand, and in 1906 the well blew out a lot of gas and some oil, sparking a rash of speculative insanity. Five-pound shares briefly traded at ten times that value.

Other provinces, suffering a bad case of sour grapes, pooh-poohed the excitement. Wrote one Christchurch newspaper: “Taranaki is dancing Maypole figures around the bore, singing songs of its youth and stopping only to carry crude kerosine home in its hat for decorative purposes . . . Now Taranaki reckons that its fortune is made, and all it has to do is to gather the cash. [The province] will become so inflated that it will explode or float out to sea. It can’t get its hat on with a shoe horn already.”

The number of oil companies in New Plymouth boomed. By 1913 several wells were producing, and several million litres of crude were in storage in New Plymouth. A little was probably used in local vehicles, and in a train that ran to Wellington, but to use the stockpile a refinery was constructed and opened amid much fanfare. Four-gallon tins were made and filled on site. Yet the following year the refinery was taken to Saudi Arabia by BP (then called Anglo-Persian) after local production failed to sustain it.

There was little further activity until the late 1920s, when entrepreneur William Fossey persuaded a few locals to put together another small refinery on the cheap. For the next 20 years Fossey ran the operation on his own, travelling the whole North Island selling to farmers and anyone else who would buy.

In his early days he missed out on a supply contract to the local council because on a trial run up Egmont the fuel solidified in the bus. “There was always a lot of wax in Taranaki crude,” Ron told me. He should know; he uses it as a polish for some of the museum’s metal artefacts, and says it dries to a tough, glossy finish.Later Fossey sold the wax to the army for waterproofing tents.

During the 1930s a few more wells were drilled in Taranaki, and two of them kept producing until 1972. Beam pumps introduced during the 1950s finally ousted the bailers, and production improved.

The 1950s and ’60s saw fortunes lift for the small oil producers associated with the field. Several pumps dispensed “Peak Petrol,” council used local diesel in its vehicles, and the gas company and Ivan Watkins Dow used the heavy fuel oil in their boilers.

Two years after the discovery of Kapuni in 1959, Shell BP Todd bought out the locals, using the refinery to distil Kapuni condensate as well as the dribble of local production. Faltering production led to the closure of the wells in 1972, but buses ran on local diesel until the tiny refinery finally closed in 1975.

[Chapter-Break]

Real success in the long search for commercially viable deposits of hydrocarbons came not on the much perforated foreshore of New Plymouth, butout among the cows at Kapuni, 50 km to the south-east.

George Cawsey, now drilling supervisor for STOS, was on the rig that night in May 1959. He’d started working for Shell four years previously as an assistant in the surveying party of a seismic team. Having had enough of trudging around Taranaki, he’d transferred to the Ideal 100 drilling rig. As a concession to his four years of involvement in the industry, he had been allowed to come on as a roughneck, working on the drilling platform. Novices usually spent a year or two as lowly roustabouts unloading trucks and cleaning up around the site before graduating to work on the rig.

At 2.30 A.M. on a Sunday morning they struck hydrocarbons in a most dramatic way. Gas pressure in the Kapuni formation they cut into at about 4000 m blew all the drilling mud out of the well. “We had mud a foot deep pouring all over the drilling floor,” says George.

Although Kapuni was only amoderately sized field, it was not easy to find immediate uses for even that amount of gas. Not until the government entered into a take-orpay agreement and formed the Natural Gas Corporation in 1967 to process and reticulate gas to nine cities formerly on coal gas was Kapuni development commenced. Unfortunately, Kapuni gas was 40 per cent carbon dioxide, and this as well as water had to be removed before the gas was fit for public burning. High-pressure gas pipelines from Kapuni to Auckland and Wellington and a gas treatment plant had to be built before gas could start flowing in 1970

Encouraged by the Kapuni discovery, government passed the Continental Shelf Act in 1964 and consequently allocated the first offshore petroleum exploration licence on October 1, 1965.

The Marsden Point oil refinery, a rather modest affair, had come on stream in 1964. The first offshore well was sunk in 1968, then in March 1969 the drill ship Discoverer II found a gas and condensate field 33 km off Opunake that was large even by world standards. This became the Maui field

There was no way that a discovery of this magnitude could be considered bad news, but just what could we do with all the gas? Kapuni provided a more than adequate supply for domestic and normal industrial use, and Maui was ten times larger.

Electricity generation provided one realistic possible use for the gas, and the Electricity Department was already considering the large-scale development of thermal power stations, since hydro sites were becoming sparse. Gas-fuelled power stations were proposed for New Plymouth and Huntly, and two evenlarger stations for Auckland. However, when the rate of growth in demand for electricity slowed, the Auckland stations were cancelled. Treasury favoured leaving the gas in the ground Without much certainty about what it was going to do with the gas (an estimated 5 trillion cubic feet plus 130 million barrels of condensate), the Labour government signed another take-or-pay agreement in 1973. But the oil crises of the 1970s did fearful things to our balance of payments (imported fuel costs rose from 5 per cent of export earnings to about 30 per cent after the first oil shock) and still left us hostage to foreign petropolitics, with dreaded carless days. Greater self-sufficiency in fuel was an enticing prospect.

Urged on by the Liquid Fuels Trust Board, the Muldoon government embarked on the Motunui gasto-gasoline plant. Synfuels Corporation (75 per cent government, 25 per cent Mobil) was established to build and run the plant in early 1982. It was projected to cost over $2 billion and produce 570,000 tonnes of synthetic petrol each year-14 per cent of our liquid fuel needs and close to a third of our petrol.

At the time, oil prices were through the roof and looked like staying there. Synfuel was predicted to cost 70 cents per litre to produce in 1987, declining to 31 cents after the plant was paid off in 1995.

Since this was the first (and remains the only) gas-to-gasoline plant in the world, reservations aplenty were expressed about it. Technically, the plant has exceeded its specifications, and can make 750,000 tonnes of petrol per annum, yet qualms remain. The Natural Gas Corporation argues that using the gas as CNG in vehicles directly would be a much more efficient use of the resource, since in the gasoline conversion process about half of the gas’s energy is lost.

Ownership of the operation has passed via Fletcher Challenge to the Canadian company Methanex, although Fletcher retained a 43 per cent interest in Methanex NZ until December 1993. (Fletcher Challenge has major stakes in almost every sector of the NZ energy sciene: it owns Petrocorp, 30 per cent of NGC, 68.75 per cent of Maui, a share in NZ Oil and Gas. an interest in the Kupe field, about 15 per cent of the Marsden Point Refinery, and Southern Petroleum is a publicly listed subsidiary). Methanex is a major international producer of methanol (methylated spirits), which is used as a raw material in the synthesis of many chemicals, including a non-lead octane-booster for petrol which is finding favour in North America.

Methanex’s interest in Motunui stems from details of the conversion process. Natural gas is converted to methanol as the first step in the synthesis of petrol. (Indeed, Motunui is the world’s largest methanol plant). For the process to operate, a reasonable amount of carbon dioxide must be present in the gas mixture. Maui gas is low in CO, (7 per cent), so now all of the gas from Kapuni (44 per cent CO.,) is diverted to Motunui without having its carbon dioxide removed. The methanol produced-5000 tonnes/day—contains 17 per cent water, which is all right for petrol synthesis but unacceptable in reagent methanol. Methanex is now installing a $90 mil‑lion distillation plant at Motunui so that when methanol prices are high and petrol is cheap (as at present), up to half the methanol produced can be purified instead of transformed into petrol. This may be good for Methanex, but represents a considerable subversion of the original intent of the synfuels plant.

Motunui and the new power plants were just two elements in a costly network of “Think Big” energy schemes. Closely allied to the Synfuels project was a separate $226 million plant that produces reagent grade methanol in the Waitara valley, now also owned by Methanex.

Another Think Big scheme over the road from the Kapuni gas treatment station is an ammonia-urea plant, which uses natural gas to make urea, a farm fertiliser. Methanex consumes 42 per cent of our total gas production, and the ammonia urea plant a further few points.

Another large share (36 per cent) is taken by the Electricity Corporation of New Zealand (ECNZ) to fuel the Huntly, New Plymouth, and Stafford power stations, which generate 33 per cent of our electricity.

Huntley converts 35 per cent of the energy present in gas to electricity. The other two stations are less efficient. A further 10 per cent of produced electricity is lost during transmission. Much electricity is used for heating, a task at which natural gas excels with high efficiency.

Critics of our present ways of using natural gas point out that Electricorp and Methanex between them waste a not inconsiderable gas field each year. Since both organisations hope to keep using gas well beyond the life of the Maui field, they have joined forces with the Natural Gas Corporation (which sells the remaining 20 per cent of our natural gas production) to encourage further gas exploration now.

Taranaki is not the only part of the country suspected of harbouring hydrocarbons. Around the edges of the land, eight major sedimentary basins are known [see diagram page 27], and more occur further afield, such as the Great South Basin south of Stewart Island—an inhospitable focus for a lot of oil optimism during the 1970s.

Licensed areas reflect superior prospects, and they are mainly on the North Island west coast, both on-and offshore. In the entire South Island there is only a single small prospecting licence held near Greymouth.

Over the years, and again at present, the east coast of the North Island from Ruatoria south to Castlepoint is attracting oilmen, and five current licences are held in the region. Oil seeps to the surface at several locations. Two of these places were known to local Maori as “the breath and fire of the gods,” and another as “the grease of the great whale.”

Compared with the approximately 200 wells drilled in Taranaki, only eight have been drilled on the east coast and 26 in the South Island.

[Chapter Break]

Once oil has been located, the production process seems almost pedestrian. Perhaps this is due to the small scale of our oil discoveries to date. Visit most of the sites and you will encounter a sturdy mesh fence enclosing an insignificant outcrop of pipes that quickly dive back into the ground. There are no people, bustle, noise—not even a gas flame.

The McKee field in the hills inland from Motunui is typical. Thirty production wells straggle across several fertile but hilly dairy farms. A network of sealed roads connects the wells to a production facility and provides the farmers with the classiest races in the country.

The crude oil produced by these wells resembles dark caramel and is solid below 35°C. Consequently, all the pipes carrying crude back to the production station are insulated and warmed with heat tape.

Like all wells, those at McKee produce both oil and gas. In fact, gas plays an essential role in extracting oil from the ground. Bleed the well at the right rate and gas will lift the oil up to the surface, as if on an escalator.

In some of the more sluggish wells, gas is reinjected into the crude down an outer jacket of the well casing to provide more lift. Water is pumped down another McKee well in the hope that it will carry more oil to surrounding wells as it permeates the reservoir rocks.

At the production station, crude is heated to 65°C and water, gas and oil separated. A chemical cocktail is added to liquefy the waxy crude for its 40 km pipeline journey to the Omata tankfarm at New Plymouth. Oil from several small fields in central Taranaki—Kaimiro, Tariki, Ahuroa, Waihapa, Ngaere, Ngatoro—is accumulated there awaiting export.

The New Zealand Refining Company at Marsden Point—controlled by the big oil companies—hinders Petrocorp (owner of many smaller producing wells) from processing oil there in its own right. Hence much Taranaki oil is exported, while overseas crude is imported to supply the petrol we need to fill our tanks. The syngas produced by Methanex at Motunui is actually full-fledged unleaded petrol which is pumped to Port Taranaki for shipping around the country.

I’m told that even unleaded petrol for consumption in Taranaki is pumped on to coastal tankers . . . and then offloaded for local distribution.

Unleaded petrol does not go to Marsden Point, since it requires no refining, but Mountie also produces higher octane products that can and do go to Marsden Point for blending with other petrol.

Upgrading the Marsden Point refinery was another major component of Think Big. It took five years to accomplish in the early 1980s and cost $1.8 billion. Although not particularly large (capacity 95,000 barrels/day), it is now considered one of the most versatile and sophisticated refineries in the world. Versatility means that it can process almost any sort of crude oil the rocks have fermented.

Crudes vary widely in their properties, and somewhat in cost. Essentially a refinery fractionates the very complex mixture of compounds present in crude oil into a series of useful products that range from very volatile (petrol), through to solid bitumens

Marsden Point also possesses a hydrocracking unit that uses heat, pressure, and hydrogen gas in conjunction with catalysts to break down some of the large, less volatile components from heavy Middle East crudes into the more volatile (and valuable) compounds used for vehicle fuels. Think of it as an ultra-fast, above ground version of the geologist’s subterranean kitchen. Of the 4.5 million tonnes of crude oil processed by the refinery in 1992, about 1.3 million tonnes originated in Taranaki (from Maui and Kapuni). Diesel is the major product. but petrol, aviation fuel, heavy fuel oil for ships and boilers, and bitumen are all significant. Petrol refining costs are three cents per litre, and probably less for some other products.

Sulfur is an unwanted contaminant of many crude’s, and some 20,000 tonnes annually is isolated and sold to a local fertilizer manufacturer. Carbon dioxide—another byproduct of refining which is short on friends these days—is sold for industrial use. Products from the refinery are not only sufficient to furnish our fuel needs, but some 15 per cent of production is exported around the Pacific. The refinery is New Zealand’s premier stock on local exchanges. While most shares languish between 50c and $5, New Zealand Refining Co stock has changed hands at peak values exceeding $42 this year, more than double the value of any other share.

Of the 37 million barrels of liquid fuel we use each year. only 35 per cent is indigenously produced. Oil equivalent to another 20 per cent of local use (7.4 MMB) is exported by Petrocorp. If Methanex diverts production from gasoline to methanol, our self-sufficiency will drop, and unless more gas and oil are discovered, depletion of existing reserves will start to erode that 35 per cent in less than five years. Plans are afoot to start development of the Kupe field, off Patea in south Taranaki, but this field is considerably smaller than Maui.

Dave Crawford of the Petroleum Exploration Association of NZ (PEANZ) is concerned that insufficient exploration is being done. “Petrocorp is doing a great job, especially in onshore Taranaki, but it is unlikely that any large fields remain undiscovered there. What we really need is more offshore drilling, especially outside Taranaki. This sort of work has faded dismally in the last few years. The only significant operation planned for this year is a well to be drilled by the American company Amoco (with Todd, Taranaki Offshore and Mobil NZ as partners) off the Wairarapa Coast in October. It would he great for New Zealand if Amoco came up with the goods. That would encourage people to take a greater interest in all our other sedimentary basins, and break the notion that NZ is just a one-basin country.”

PEANZ considers that the government’s proposed new minerals regime will do little to attract vital overseas exploration dollars. Although it abolishes the hated 11 per cent Crown Carried Interest, the Crown’s share of the profits remains too high, Crawford says. “While government argues that it takes less than many other countries in the region (NZ about 55 per cent, Australia 69 per cent, PNG 81 per cent, Malaysia 93 per cent), that ignores the fact that globally we have an exploration investment ranking of 40. whereas those other countries are 5th. 19th. and 11th respectively.”

This ranking is based on factors such as rates of discovery and market size, and is a major liability ignored by government. PEANZ argues that the cost of failing to discover more oil and gas will be high. “Our production of oil saves us $600 million/year in imports, Methanex earns $400 million in import substitution and methanol sales, and the cost to ECNZ and other users of having to substitute more expensive fuels for gas is estimated to be $335 million/year.

“Against these great costs of no local production, the Crown gets $35 million/year in royalties. We have already consumed 50 per cent of our known oil and 31 per cent of known gas reserves, and most of that in little more than a decade. You can see why we think that government should be doing more to encourage exploration. If we haven’t come up with substantial new gas finds within four years. users will have to start purchasing oil- or coal-fired plant.”

According to PEANZ, we need to be spending $100 million per year on exploration (four or five offshore wells) to have a good chance of making a big strike, rather than the current $30 million.

Perhaps tarnishing some of these figures is the consideration that producers will want more money for gas in the future. Under the “take or pay” agreements. government buys Maui gas at $1.48/gigajoule (well below world prices) but resells it to NGC at $2.64/GJ. The 80 per cent mark-up is probably similar for gas the government sells to Methanex and ECNZ, and is made up of a “Crown margin” and a “Crown energy resource levy.”

These charges would not be payable on new discoveries where the government was not involved. A recent study concluded that new gas would need to return $3.60/GJ to Producers. So this could reduce its attractiveness to bulk users.

[Chapter-Break]

Apparent universe away from debates about energy policies (inducted by nattily suited businessmen and bureaucratsui comfortable offices, grimy drillers and scruffy field geologists continue to wrestle the rocks on the ridge above McKee. A few days after my visit, I hear the effort has not been in vain. Not only have the target structures been hit, but nearby strata have also yielded hydrocarbons in what could be respectable amounts. More wells are on the agenda.

Well, the old naptu hasn’t worked out too badly. It would indeed be hard to conceive of modern life without it, and petroleum jelly isn’t that bad as an ointment.Perhaps we should reconsider the donkey juice …